Emerging areas drive demand in Sharjah residential projects, report finds

Savills’ Sharjah Market Spotlight highlights tenant preference for new and upcoming areas of emirate

Sharjah’s growing population is driving demand for residential units across new areas of the emirate, especially Emerging Sharjah, where enquiry levels saw a 50% rise from the first to the second quarter this year and are expected to continue rising for the entire year.

A report by real estate service provider Savills says demand has spiked remarkably in Emerging Sharjah owing to residents prioritising community lifestyles, security, good amenities and facilities and easier commuting. Meanwhile tenants Sharjah city look for affordability, unit size and flexible payments, the Savills research found.

“Sharjah’s mature social infrastructure, vibrant retail environment and a relatively affordable cost of living has set it on the map as a preferred residential destination across the UAE. With limited space and historically high land prices, developers of new residential projects have looked to the outskirts of the city where congestion is lower and development land is not in short supply”, said Suzanne Eveleigh, head of Sharjah – Savills.

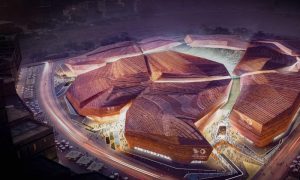

For instance, recent projects with excellent connectivity to other emirates such as Al Zahia, Al Jada, and Nasma Residences offer good quality development at relatively affordable rates, Savills found. This Iis attracting more tenants and causing steady movement of residents to these locations, which is in turn promoting the growth of businesses, retail and associated facilities in the areas.

“The market in Sharjah is quite price sensitive and most of the city’s tenants consider the emirate because of its affordable rents. Thus, tenants will continue hunting for the best value. Relocating to Emerging Sharjah can ease commuting times significantly, offer lower congestion and easier access to major road networks. There is a notable growth in the number of mixed used developments which is expected to attract business and create a live, work and play opportunities in these newer communities,” Eveleigh added.

Savills’ research found that In terms of the most attractive micro-markets, University City is leading with 36% of the total demand followed by Al Khan with 24%. High-end residential buildings in Al Zahia gated community and Garden apartments charge higher rental rates compared to high-end buildings in Central Sharjah, unlike Muwailah and Muwailah Commercial that have more affordable prices.

According to Shane Breen, director of Commercial Valuations and Consultancy Services at Savills,Sharjah, “gated communities in Emerging Sharjah and ready-to-move-in projects such as Al Zahia are the first examples of how future master planned communities will be received in the market”. He added: “Average annual rents for studio and one-bedroom apartments in Al Zahia currently command a 5-10% premium on comparable properties in Sharjah City, within the high-end apartment segment.”

Other Emerging Sharjah communities around University City, have seen a spike in demand from professionals working in the surrounding areas. Established commercial areas such as SAIF Zone and Sharjah Airport have experienced significant growth over the past five years which helped to create demand for residential properties nearby.

Savills added that the growth of the Sharjah School District has also helped generate significant demand from families relocating to be closer to their children’s schools. The growth in the number of university students as well as the development of new communities within Emerging Sharjah has resulted in rise in the number of students choosing to source their own accommodation off campus. For instance, high-end studio and one-bedroom apartments in particular across Muwailah Commercial have seen a rise in student tenants over the past few years. Affordable rents, modern amenities and supporting facilitates when compared to on campus student accommodation, are the primary drivers for this trend.