Drop in prices in Jeddah making property more accessible to Saudi nationals

Expatriate family departures could help housing to be more affordable

Approved Content

Research by KPMG suggests there has been a price correction in the Jeddah real estate market following the departure of expatriate families from the city.

In 2017, rentals of residential apartments dropped by 10-15% in Jeddah, and is contrary to the upward trend witnessed in the preceding years, according to a Real Estate Market report produced by KPMG Al Fozan & Partners.

It explained that the drop in rentals came as a “consequence of the departure of families of some expatriates, especially those with middle income, which contributed to an increase in the vacancy rate in the market.”

The report also noted that the average rental rates of apartments range between SAR 20,000 and SAR 28,000 in eastern and southern districts of Jeddah, while the average rentals range from SAR 35,000 to SAR 45,000 in the northern and western districts of the city. The average sale prices of apartments in the city range between SAR 2,500 per square meter (southern side) and SAR 6,000 per square meter (western side). However, these prices can go up to SAR 10,000 per square meter in high-end projects that offer additional amenities and services.

The report further described that the sale prices and rental rates of residential villas continued to decline during 2017. The trend was first noticed after the implementation of the white land tax, which led to cautious behavior from investors and end-users, resulting in a considerable drop in activities in the segment.

However, the sale prices and rentals of villas in the western districts of Jeddah are the highest, especially Al-Shati, Al Hamra and Salama, compared to the other districts of Jeddah. The average sale price of villas in these areas is SAR 7,000 per square meter. The average rentals of villas ranged from SR 120,000 to SR 150,000 annually, based on their size, location, accessibility, quality of construction and finishing, construction age and proximity to major commercial areas. The average sale prices of standard villas vary between SAR 4,500 and SAR 5,500 per square meter in northern and eastern areas, while in the southern side, it is SAR 3,500 per square meter.

Commenting on the report, Eng. Rani Majzoub, Head of Real Estate with KPMG Al Fozan and Partners, said:”While the Residential Real Estate market in Jeddah is currently witnessing a correction in the sale and lease rates, this would serve the interest of the nationals by reducing cost of housing which is a primary objective of any Government. Eng. Majzoub added:”the attractive investment opportunities is for Real Estate developers who bring with them value-added Real Estate products/services and take into consideration the needs and abilities of their end users; since the old strategy of buying, keeping, and speculating land prices has no future potential anymore.”

“The new residential villa development projects will be appropriate in the northern area, Abhur, due to the increased demand and modern infrastructure. Meanwhile, the eastern areas of Jeddah are suitable for the apartment development projects because of their proximity to the city center and the available integrated road network”, he added.

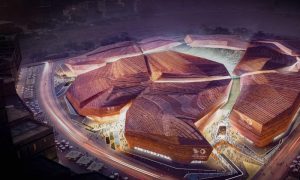

With a current Jeddah residential market supply of 0.8 million units, the report expects an additional supply of 30,000 residential units by 2020 of which the majority of this upcoming supply will be provided by Al Ra’idah Investment company, owned by the Public Pension Agency, that will deliver 6,160 apartments and 1,180 villas in different phases. In addition to other prominent residential projects, such as the Gardenia Residence, Al Farida, Al Mayar, Masharif, Diyar Al Salaam and finally Al Hilal Tower 2.

The report added that the majority of the new supply is focused towards the north and east sides of the city as the central zones has become saturated with limited availability of land, while seafront areas are expected to offer further high-end products in the future.

KPMG’s report revealed that the performance of the retail sector remained subdued in 2017 and market has witnessed a modest decline of 4-5% in rentals. The report also indicated that the new upcoming supply (if delivered as announced) amid ongoing slowdown is likely to put more pressure on the rental rates.

Regarding the office sector, the report pointed out that both rentals and occupancy rates have dropped over the past year. While there has been a modest decline in rental rates of Grade-A offices, rentals of Grade-B office buildings located at secondary locations witnessed a higher drop of 8-10%.

Eng. Rani Majzoub said, “Given the characteristics of the recently delivered and upcoming office buildings, we expect a further reduction in rentals of Grade B office buildings with poor maintenance and limited amenities. However and as the government is actively working to attract foreign investments into the country, such investments are likely to generate more demand for office spaces in general.”

“There was around 25,000 square meters of new office space completed during 2017, bringing the current stock to approximately 1 million square meters. Furthermore, it is expected that around 200,000 square meters of office space is due to enter the market in the short to medium term. ” Eng. Majzoub added.