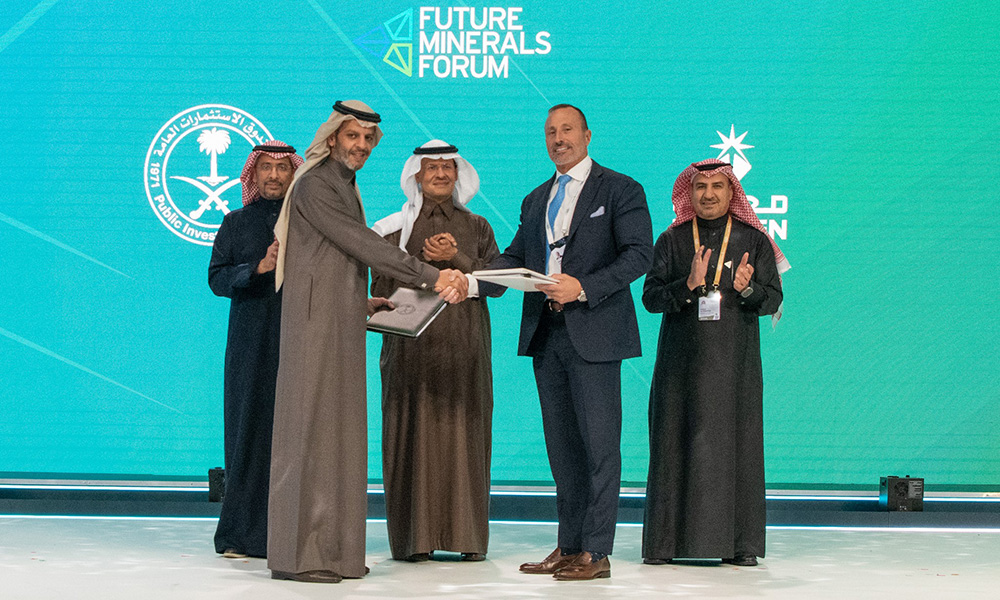

PIF and Ma’aden sign JV to establish new entity to invest in global mining assets

The JV will have a capital of $50mn and will initially invest in iron ore, copper, nickel and lithium as a non-operating partner, taking minor equity positions

Saudi Arabia’s Public Investment Fund (PIF) and the Saudi Arabian Mining Company (Ma’aden) have signed a joint venture (JV) agreement to establish a new company that will invest in mining assets globally, to secure strategic minerals that are essential for Saudi Arabia’s industrial development, as well as the resilience of global supply chains.

In a statement, the companies said that the new JV entity will be incorporated after obtaining approvals from the relevant authorities and satisfying certain conditions of the JV agreement. Ma’aden will own 51% and PIF will own 49% of the company. The company’s capital will amount to US $50mn.

Yazeed Alhumied, Deputy Governor and Head of MENA Investments at PIF said, “PIF and Ma’aden combine extensive investment expertise with deep sector knowledge. The new company will significantly contribute to strengthening Saudi Arabia’s strategic position as an important link in the global supply chain in line with PIF’s strategy to further grow key industries.”

He added, “As a catalyst of Vision 2030, PIF continues to drive the growth of new sectors, and companies, while contributing to job creation, technology transfer and localizing knowledge to build a prosperous and sustainable economy in Saudi Arabia.”

In mid November 2022, PIF and BlackRock signed a MoU to jointly explore Middle East infrastructure projects.

The company aims to initially invest in iron ore, copper, nickel, and lithium as a non-operating partner taking minority equity positions. This will provide physical offtake of critical minerals to ensure supply security for domestic mineral downstream sectors, and position Saudi Arabia as a key partner in achieving global supply-chain resilience, the statement explained.

Robert Wilt, CEO of Ma’aden commented, “This is a significant step for Ma’aden as we develop the mining sector in Saudi Arabia and position the Kingdom as a key ally in securing the metals of the future. The global energy transition relies on the strategic minerals needed for renewable energy and battery storage, and our focus on these will give us a foothold in the global commodity value chain, where major supply constraints are combined with growing demand.”

“We are proud to be playing a leading role in the economic diversification and growth of Saudi Arabia, building the talent pool and securing the future for the country, as we help deliver Vision 2030.”

The agreement is in line with PIF’s mission to build strategic economic partnerships to achieve sustainable returns and unlock the capabilities of promising sectors with significant long-term growth potential, in line with Vision 2030.

In late November 2022, PIF subsidiary SEVEN said it would invest $13.3bn into 21 integrated entertainment destinations in the Kingdom.

It also aligns with Ma’aden’s 2040 Strategy to focus on upstream mining activities and gain exposure to future minerals as well as build partnerships with global mining companies.

In early January 2023, it was announced that Diriyah would become PIF’s fifth giga-project.