Where’s the magic in the Kingdom?

Saudi Arabia is in a strong fiscal position to push on with Vision 2030 development, however it may be constrained by capacity and supply chain funding writes David Clifton

This year has seen the global economy reel from the consequences of a decade long quantitative easing (QE) binge combined with the costs of the pandemic. The war in Ukraine only acted as a compounded effect, the majority of the current fiscal effects were already built into the system. Subsequently, the world is either in or trending quickly towards a recession in 2022 that will last all of 2023 and depending on government responses has the markers of lasting a fair proportion of 2024 as well.

With the continued geopolitical risks, not just in the Ukraine war, but with uncoordinated global policy and disparate political situations in major economies, we see significant global risks that might be capitalised on by nations without such wranglings.

With the ECB having raised rates by 50 basis points, in light of the Fed having led the market with a 75 basis points rise and again a further 75 basis points on 27 July, we expect to see 1-2 more rate rises in 2022 at a US level, forcing a similar move for the ECB and BoE – which would be followed by GCC countries with currencies pegged to the US dollar.

This will have the potential to drive further inflationary pressures due to the supply side issues. Most industries, having not seen a pre-pandemic return to the demand levels of 2019, will raise higher costs of capital to support growth to pre-pandemic capacity, driving a pass through of costs to end users.

Inflation is still trending to the previously forecasted global 10% and certain nations will exceed this level. As the cost of energy is a driving factor, for now this indicates that Net Zero considerations are largely on hold, despite the ambitions and commitment to them. This model will only create more of a reduction in standards of living and a further degradation of developed nations debt-to-GDP, as they borrow more in what is becoming a standard response to crises.

For the GCC though, should the governments wish to take a long-term Net Zero view (which largely they do), then the investment cycle and 20+-year horizons to achieve this can be met.

We’ve seen global supply chains start to speed up their capacity to mitigate the pandemic and invert some of the supply-side problem, although it should be noted that few industries are fully back to pre-pandemic demand levels.

Oil over $100 barrel drives confidence in infrastructure and non-oil economic investment by regional governments. Historical award trends show that the higher the oil prices, the greater to commitment to major schemes of work – although there is a lag of 6-18 months. Pertinent examples include the high oil prices of 2011/12 which drove the Riyadh Metro, Midfield Terminal and Doha Metro.

We expect to see continued economic stimulus due to post pandemic recovery, which the region is best placed for internationally due to the fiscal balance of the oil economy. Due to an increased income of approximately $735mn (KSA) and $130mn (UAE) per day year to date, we expect economic confidence in the deployment of this reserve. KSA will likely be via PIF and UAE via a combination of central/federal government and PIF.

Saudi non-oil PMI data is incredibly strong at 57.0 for June 2022, rising from 55.7 in May (any score over 50 is a growth market). This is even with the inflation pressures being seen (although at a much lower level than other countries). Although partially attributable to the post pandemic recovery, the stimulus being provided by the PIF internal investments and market sentiment regarding the future developments of the Kingdom are driving a positive perception as well as starting to produce work orders.

The key GCC countries are expected to see extended GDP growth of 14% in KSA in 2022 and 5.4% in UAE, due largely to oil output and price rises (KSA has a 42% oil-based economy vs 16.2% for UAE). However, the benefits to the regional economies who are not major producers will be greater than most international competitors due to the trickle-down effect and inter-governmental support for them.

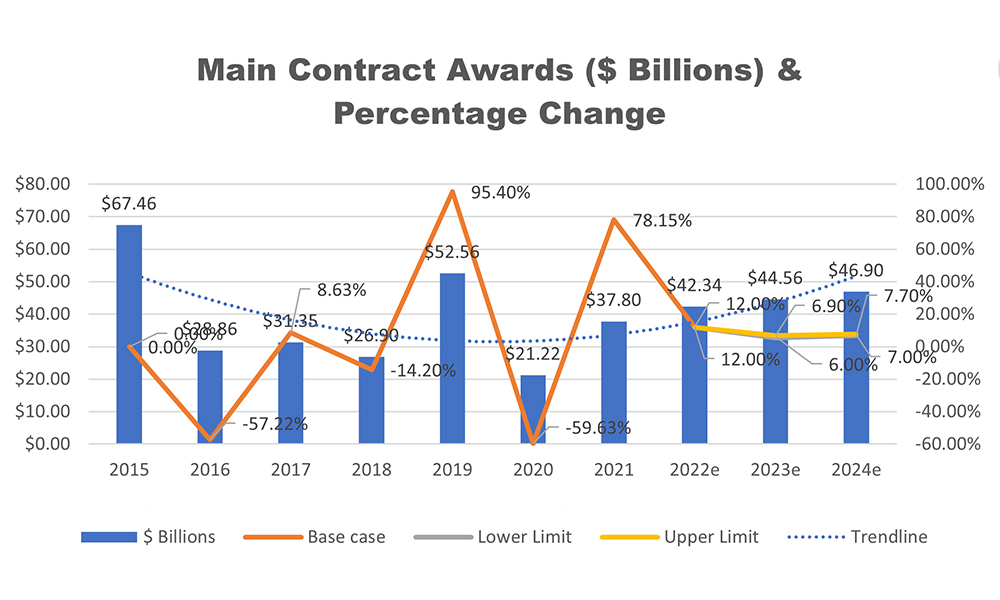

Within the Kingdom, we are still seeing a very significant amount of tendering of main contract works, although the awards trend is still only slightly above initial forecasts. This is in certain areas leading to ‘tender fatigue’ in the supply chain as the quantity of works being sent to market (or re-sent to market – which is common) is causing a significant rise in pre-contract costs. Combined with supply chains expecting an awards boom in KSA, we are starting to add risk and increase profit margins and prelims (some of which is pass through costs of the quantum of tendering) in what is now trending towards a self-fulfilling prophesy.

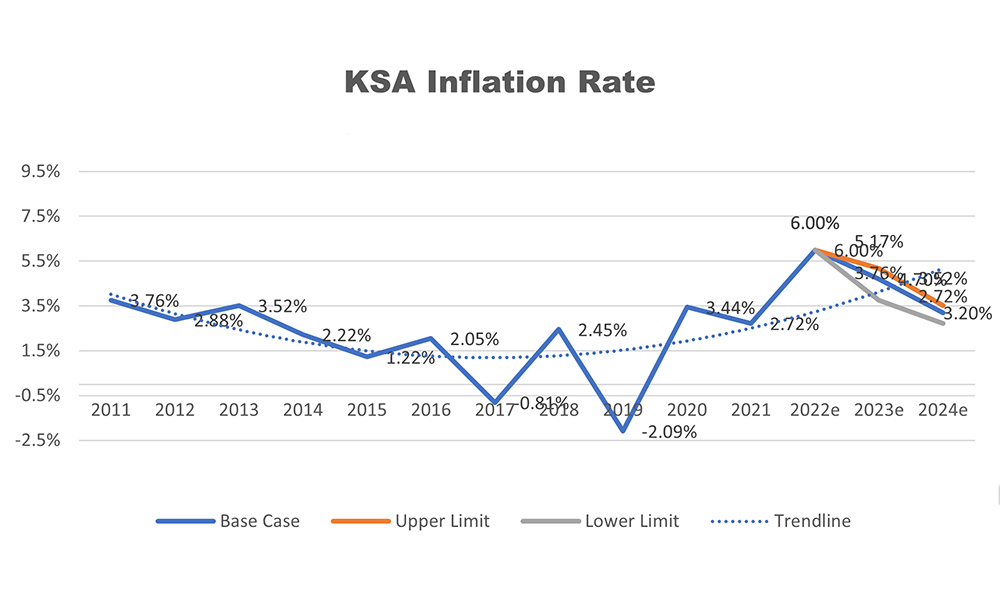

With the post-pandemic recovery, poor global economic responses to the situations, the ongoing war in Ukraine and challenges around market perception of the awards in Kingdom – which are that the market will double year on year at least, construction inflation is set to peak at over 10% this year, whilst CPI (consumer price index) will only be 6% (higher than KSA government forecasts, but unless major subsidies are brought in, this estimate is closer to trend).

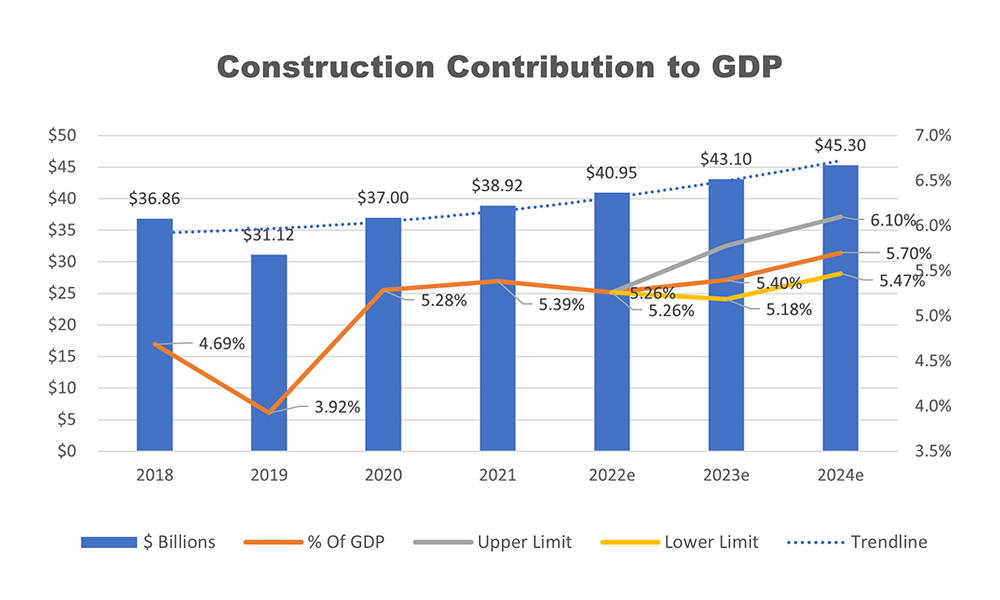

Construction as a contribution to GDP is steadily rising from the 2019 low, although it should be noted that this is largely a consequence of projects awarded pre-pandemic. We see this trend likely to continue due to the forecast increase in awards, with a Compound Annual Growth Rate (CAGR) of approximately 5% in our forecasts.

When looking at construction material prices, we have seen a softening in the market, as the shock to the system due to the Russian invasion of Ukraine is muted by the supply side reacting to the loss of certain input products. The price points though are still significantly above historical market trends.

If we take one example, landed (in Kingdom and available for purchase) rebar prices have started to reduce in Q2 as global prices decline quickly. There is a lag between price falls due to supply in the global market increasing and translation onto the ground. This is in part due to stockholding requirements, meaning that previously purchased product needs to be sold prior to re-ordering and also shipping time to country.

Looking at the futures market, we can see significant price reductions through the rest of 2022 and with a recession on the horizon for major economies, this trend is expected to continue. By comparisons to 2021, we have seen a 2% price reduction and we forecast 2022 to reduce by a net 7%, based on increasing global production capacity and the spike in costs due to the Russian invasion of Ukraine having been fully passed on it this material during Q1 and early Q2.

When looking at the drive for development, we haven’t seen as many awards as the market expected. This presents a potential risk as, due to the major contraction in awards during the pandemic, the industry has a ‘drop off the cliff’ potential in 2023 and 2024 as projects from before the pandemic will complete. This means the country has a backlog burn issue that needs to be addressed swiftly if capacity is to be maintained, let alone grown in line with forecast requirements.

With a suite of major awards due in H2 2022, from hotels at The Red Sea to a select number of major packages at NEOM, we still forecast a 12% increase in awards in KSA of around $42.3bn.

The will of the clients and the hope/perception of the market is significantly higher, but a combination of red tape, delayed decision-making, capacity and capability, as well as logistics, make this assessment close to the maximum the current supply chain can absorb.

When combined with the ability and the cost to finance working capital for the supply chain (which will increase further this year and more next as the Fed looks to tame inflation even if contributing to a recession), the delivery models won’t support much more growth – certainly when compounded by the challenges of getting qualified and experienced staff and the issues of getting visas for the workers who are needed, even if funding is secured to enable this.

To this end, we are seeing examples where PIF is looking to secure its own capacity. The most publicised example being the 30% stakes it is looking to acquire in four major contractors in the Kingdom (El Seif, Al Bawani, Al Mabani and Nesma).

Whilst we now expect a global recession on the horizon, with sustained high energy prices for the foreseeable future, Saudi Arabia is in a strong fiscal position to push on with development in line with Vision 2030 and the delivery of the giga projects won’t be abated in the short term by lack of capital to be deployed. But it may be by capacity and supply chain funding. This will mean a need to keep differing delivery models in mind, whilst also ensure entities can attract suppliers with reasonable contracts and swift payments to ensure continued commitment from the supply chain.

To conclude, the short-term future at least is bright, perhaps not as bright as market perception, but certainly on a solid growth trajectory.

Read more:

- Drive for development: Is Saudi Arabia moving forwards asks David Clifton

- Magic Kingdom – The outlook for Saudi Arabian construction

- From vision to reality, delivering The Red Sea Project