Drive for development: Is Saudi Arabia moving forwards asks David Clifton

David Clifton takes a look at how the outlook for Saudi Arabia has shifted after a tumultuous first quarter

2022 started with a major imbalance between all forecasters and analysts’ expectations from the end of 2021 and the real environment. This is of course driven by the act of war in Ukraine by Russia. But what it’s meant for the global, regional, and Saudi economy is a compounding effect of some expected results of the pandemic.

We now see inflation on the move towards 10% globally and a forecast of just under 9% for KSA for 2022. This is driving a range of monetary and political policy. Some of which has been expected – the reigning in of quantative easing (QE) and now the increasing central bank interest rates which is driving the cost of capital up through the two actions.

For the fortunes of the Kingdom, we’ve seen oil rise to $120 per barrel at a point, which from a budgetary perspective is significant. The 2022 budget was predicated on c.$60 per barrel and as an indicator, a sustained $120 price would generate $732m of extra revenues per day (although both figures it should be noted are based on Brent Crude, not Saudi Heavy Crude which trades at a significant discount. Further of note is the major supply deals concluded regularly was a with Eastern powers that won’t show as a barrel price until published by ARAMCO) – which is a positive for the Kingdom in terms of deploying new revenues for development of the economy. The price pressure seems likely to continue even after the strategic reserve release by the USA. How OPEC+ acts will be interesting to observe, but in practice, the increase of production, should it happen, will take 3 months to meet the market.

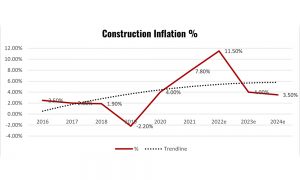

Looking at the KSA development market, we’ve seen a c.78% increase in awards from 2020 to the end of 2021. However, we’ve only seen an industry personnel increase of just under 1.5%, so we are now in the realms of forward capacity issues, underpinned by continuing input price pressures.

What we are and will continue to see in addition to capacity is capability constraints that exist in the market in KSA. Resources are challenging due to the major pandemic and contract completion trend in 2020 and 2021. This has meant a significant backlog issue for the supply chain, with most other major projects scheduled for completion in 2022 and 2023, the industry faces an issue in terms of resource risk and skills gaps should delays occur in awards in this year.

Further factored to that is the working capital requirements of any major new scheme. Cost of capital is rising quickly and combined with historical cashflow issues in the industry due to non or late payment (and thus the finance credit risk), any attempt to grow or maintain the status quo will be a challenge.

Compounding the capital situation in the supply chain has been the lack of cost awards for COVID related delays. Time has been common, but no further revenue to cover working costs has been forthcoming in most instances. The uncompensated delays further constrain cashflow and the ability to service projects effectively.

With the Russian invasion driving market uncertainty and the subsequent reaction, the prices of materials have again spiked, although in a much shorter timeframe than in the pandemic. We’ve seen landed rebar prices decrease by 38% from December to January and then rise by 52.5% in the following month and a further 3% the following month. Other commodities and materials have had a similar trend. This is currently and will for the foreseeable future make the pricing and delivery of projects much higher risk.

When combining this with the high oil price, which in most circumstances is good economical for the region, we see continued pressure on material prices and a cost-of-living issue, which is likely to drive salaries higher – on top of the scarcity of individuals as the market bounces back from the pandemic recession.

This is likely to drive the industry into the red unless sensible client mitigation measures and negotiations occur. Which would reverse the intended increase in capacity in the Kingdom as bankruptcy occurs across the supply chain. It is well known that the turn upwards in an economy is the key driver to business failings as organisations are stuck with lump sum contracts in a rising market.

In practice, markets almost always overreact in one direction or another, but the price spikes in input prices will take many months to even out and is very dependent on future sanctions. E.g., The EU reducing oil and gas purchases from Russia (it is still spending over $250m per day with Russia) and OPEC’s future commitment to bridging the supply gap which at present seems highly unlikely due to Saudi Arabia and UAE’s opposition to supply increases.

When looking at awards for this year in the Kingdom, the forecast is revising upwards due to the recent announcements around internal investment and also the sustained higher oil price. This is also likely to see an increase in the compound annual growth rate (CAGR) due to rising prices in materials, labour and a natural supply and demand issue in the capacity of the industry.

To date we have seen Q1 2022 yield awards in line with expectation at c.$10.5bn. This trend is expected to continue throughout the year. The chances of acceleration are limited by capacity and a historical lag in tendering to awarding projects.

This is still a growth trajectory and 2023/2024 is likely to see upgraded forecasts based on a likely maintained higher oil price, a requirement to provide economic stimulus and a move towards greater introduction of alternative finance (PPP style projects) and market privatisation of government companies and the subsequent realignment of those organisations to make them more efficient and quicker to market.

The outlook for the industry for 2022 is still positive, but the challenges are significant. This can be seen in the response of the Kingdom’s largest potential customer (PIF) and their efforts to acquire stakes in the supply chain to shore up supply for the giga projects, as well as the increased revenue streams.

Attracting and retaining talent and securing supply chain capacity will be critical factors that dictate project success this year (and potentially for some time), combined with efforts to mitigate the input price risks. These are the challenges the industry faces, but with a healthy pipeline of work ahead, it is without question better than the alternative or the actual in the last few years.