Interview: Simon Moon on Atkins’ stellar Middle East results

Consultancy’s regional profit rose by 56% last financial year

The first week of June saw international consulting giant Atkins release its global financial results for the year ending March 31, 2015. Of particular interest to observers in the region were the Middle Eastern results, which analysts predicted would be a major factor in the consultant’s overall growth over the last year.

They were not disappointed, with the figures showing that the Middle Eastern business had a strong overall performance during the financial year, with revenue up 28.7% to $337.1 million, a significant increase from 2014’s $262 million. In addition, operating profit was up 56.3% on last year, a consequence of the consultancy’s continued strategic focus on major projects and programmes in the rail, infrastructure and property sectors in the UAE, Saudi Arabia and Qatar.

With operations in the Middle East going from strength to strength, ME Consultant sat down with Simon Moon, chief executive officer, Middle East, for Atkins, to discuss a wide range of topics – from his take on regional operations, to how the consultancy is looking to tap into an underutilised resource in the job market.

The first order of business is to ask him why operations in the Middle East have been such a resounding success. He puts it down to a fairly simple reason:

“All the bits of the company have significant projects, but the amount of major projects that we have in the Middle East, if you look across [the region], we have three metro projects that we’re designing at the same time – in Riyadh and two in Doha, and those are pretty significant group-wise. Then as well, we’ve got the major roads and drainage programme in Qatar, and there’s also some of the big property projects we’ve got underway across the UAE.

“There’s been a good set of results that I think signify the focus that we’ve had over the last three or four years, focusing on those major programmes across the region – in property, infrastructure and rail across the UAE, Saudi Arabia and Qatar. It’s very exciting and it shows good focus.”

Despite speculation that the regional construction industry will suffer as oil prices continue to fall, Moon remains confident that Atkins will not be too adversely affected, due to the strategic decisions taken by the firm. “We’ve not seen a massive impact as a designer at the moment. A lot of the projects that we’re involved in are government projects, even the property projects are being driven by government sentiment and aspirations. We’ve seen those continue to have a very strong commitment.”

“If you look at Qatar, a lot of their major infrastructure going in there is around their vision for 2030. It’s the same in Saudi Arabia. So I think the major transportation programmes don’t seem to have been affected. Certainly not the current ones that are being delivered. And if you then look at the real need in Saudi Arabia for their economic diversification, the work that we’re doing with the economic cities and so on, those don’t show any sign of having their budgets cut.”

However, he does concede that there will be some sort of correction within each government, pertaining to the overall spending of the budget. He explains that it is because of global events like the fall in oil prices that Atkins remains resolute in focusing on projects that have long-term integrity and aren’t specific to one-off events.

“I think we’ve found a way to avoid any major downturns in the market,” Moon says. “But if the question is broader, can the Middle East continue with these low oil prices, without correcting their budget spend? I think that it’s unlikely. Even though Saudi Arabia has clearly said that they have the reserves to continue, no matter what the oil prices are – and that’s probably true – but with the change in ruler, they’ve looked at what’s important and what the priorities are.”

“Clearly security has increased in their priorities, social cohesion has increased in priority, and so has healthcare, education and proper transportation networks. Those things are, I think, underlying and have a real greater need. They will stay committed to them, rather than the short-term oil prices,” he explains.

Meanwhile, Moon expresses satisfaction with the way operations in Dubai are proceeding, with the consultancy involved in a number of major projects, driven by major developers like Emaar and Meraas.

“Over the last six months we’ve talked to clients like Meraas and Emaar and seen some pretty significant schemes launched. If you look at the Deira Waterfront, you’ve got all these developments by Meraas around the drive of the canal, through to Jumeirah and Satwa.

“There are some really interesting projects that have a real purpose behind them in terms of creating more integrated places to live, work and play.”

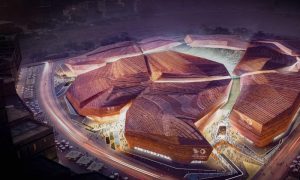

“We’re certainly involved in a number of those, even with Habtoor, on the Habtoor Residences project that will be on the canal. Then there’s the Prince Sultan Cultural Centre in Jeddah. These are the types of projects that we get really excited about being involved in. Those that have a bit more integrity about them, which look at how you can have a mixed-use development with some decent urban realm. These are the types of things that we’re following, and I do see these projects continuing to come through, particularly in Dubai. There are some big schemes coming through there,” Moon says.

Qatar is another market with intriguing possibilities for Atkins, even with the uncertainty currently surrounding it thanks to the storm of allegations swirling around Sepp Blatter and FIFA. Despite this, Moon insists that the World Cup, whether or not it stays with Qatar, will not be a factor in Atkins’ operations in the Gulf state.

“We’re very much focused on, as I said earlier, the types of projects that have something behind them, that’s more than a single event. If you look at the investment Qatar is making in the Metro system, in the local roads and drainage programmes, those are the projects connected to the national vision, and the World Cup just happens to be a milestone along the way. They’ve always been very clear on that. The work that we do with the Central Planning Office, which is at the heart of government in Qatar, is very much about properly planning that infrastructure spend over the long term, aligned with the national vision.”

Given the pipeline of projects that Atkins has in the Middle East, perhaps it’s time for the firm to step up its recruitment efforts? Not so, says the CEO. He explains that the consultancy’s delivery model is very much about exploiting regional capabilities, in tandem with the firm’s global capabilities. Though revenue growth is most definitely a target, regional staff numbers aren’t expected to increase.

“We use our design centres here in the region, as well as design centres around the group and in India. If you look at something like the Gold Line in Doha, for example, that’s being delivered with a strong team on the ground, with about 30 to 50 people in the city, close to the DMB contractor. Then we’ve got stations in design in Hong Kong, the UK and India. That’s a more agile model for us, so that we don’t need to be putting a lot of boots on the ground in the Middle East.

“Having between 2,500 and 3,000 people is a good solid base. Any more than that and I think you expose yourself to the vagaries of the region. It also means that we can crank in the best skills that we’ve got in design and engineering, from around the world.”

Despite not having fixed recruitment targets, Moon does reveal that the consultancy is making a concerted effort to target an under-represented sector in the employment market, that of the young GCC population. Getting employees from the region more actively involved in the firm’s operations is something of a personal mission for Moon, who explains that he sets annual hiring targets.

“Surprisingly, we find it easier to recruit nationals who are female, rather than male. They seem to be a lot more eager to go into the private sector and into professional organisations. If you look at architecture, we recruit 20 to 30 graduates a year, and I insist that a quarter of those have to be nationals, and that 50% of the graduates have to be female.

“We actually find it easier, particularly in Saudi Arabia – which is really interesting. We get some really talented female Saudi Arabians wanting to join us. It’s mostly in architecture and engineering, but nevertheless, we find it quite exciting.”

While there are rules and regulations in place to encourage nationalisation, Moon insists that is not the primary factor driving recruitment of locals.

“This is more about the fact that I really believe that if you’re in those countries [in the GCC] and if you’re representing them, then you can be much more effective with clients if you have local professionals working with you. So actually the diversity drive, both in terms of ethnicity and gender, from a national’s point of view, is quite exciting, and we’re doing reasonably well in that space.”