Linesight eyes bigger piece of data centre pie in Saudi Arabia

The company is currently working in over 40 countries on project developments worth more than $31bn globally and $7bn in the GCC

Riyadh-based Linesight is keen on tapping into the Kingdom’s growing data centre pipeline, as the country works to build an economy based on technology and knowledge, in line with its Vision 2030 initiative, the firm has said.

According to a statement, the firm has had several recent data centre contract wins, which takes its active project value to in excess of $500m. The firm says it is now preparing for an influx of new data centre contracts in the fastest-growing cloud adoption market in the region.

“An increase in demand for managed services such as cloud computing and IoT will be central to the digital transformation across Saudi Arabia’s society, government, and economy. This is expected to provide a catalyst for the growth of the country’s data centre pipeline. With our expertise in cost estimation, project management, benchmarking and strategy implementation, we plan on increasing our capacity for managing data centre projects across the kingdom,” said Linesight Middle East regional director Ciaran McCormack.

Managed services such as data storage, data maintenance, and remote access to applications have seen significant growth in Saudi Arabia in recent years, the statement pointed out. This is in line Saudi Telecoms Company’s (STC) plans to build 12 new data storage facilities by 2022, to replace legacy systems, while the country’s private sector businesses look to take advantage of the opportunity to outsource operations to reduce in-house operational costs related to managing data, McCormack explained.

The firm said that the growing volume of big data generated each year can be attributed to the implementation of a new ICT strategy; an expanded rollout of fixed broadband, fibre and 5G; the adoption of smart city initiatives, and advances in technology, e-government, and e-commerce.

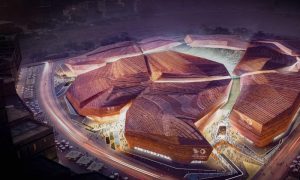

The Kingdom’s tourism sector is increasing demand as well, as a result of the giga-projects announced as part of Saudi Vision 2030. The projects are all said to require high levels of digitalisation. The country’s consumer market for mobile and internet is also driving demand for local clouds and data storage, with Saudi Arabia boasting the highest number of mobile phone users than any other country in the world (188 registered mobile phones for every 100 Saudis), one of the highest social media penetrations in the world with 25m social media users in January 2020.

McCormack commented, “With Saudi Arabia’s tourism project pipeline, Vision 2030 strategy, increasing consumer demand for mobile and Internet services, and for user data to be kept and stored in the country to increase security and ensure data ownership, we anticipate that the kingdom will continue to push for more storage facilities through data centres. This, in turn, is spurring the demand for servers, cables, networking equipment, storage space, and physical server racks and chassis, thus driving the market for the data centre infrastructure and capacity in short to medium term. Our reputation and experience as the ‘go-to’ consultants for project and cost management of data centres in the GCC with a capital value of over $1.5bn, puts us in a good position to capitalise and contribute to Saudi Arabia’s plans to rethink its data centre strategy and architecture, driving demand for local clouds.”