Solar revolution in Middle East energy

The solar industry is going through what can be considered a revolution in the Middle East: while progress in distributed and centralised solar power plants has been slow to take off, recent developments show that the situation is changing rapidly, and as expected, we are now seeing solar emerge as a significant new sector in the power generation. While the world has ramped its overall solar photovoltaic (PV) capacity from about 1.5GW to about 150GW in the last 15 years or so, the region has increased its project portfolio of existing and projects in development from just about nothing to about 3GW today in about the same time span.

Despite the fact that the Middle East is home to some of the world’s largest hydrocarbons reserves that have built up over millennia, countries here are now beginning to tap into the power of sunlight, created just under nine minutes before it is transformed into electricity by photovoltaic panels that can be installed on roofs or ground mounted. For an oil-rich region, this is a remarkable shift, and the Middle East is setting new benchmarks in the cost of electricity generated from solar energy.

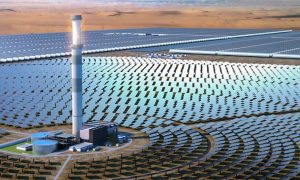

A number of recent solar projects in the Middle East have been breaking records. In 2012, developed by Saudi Arabia’s ACWA Power, the solar thermal project in Ouarzazate, Morocco – Noor 1 – was, at the time of its contract being awarded, the largest concentrated solar thermal project in the world at 160MW.

In the UAE, the Dubai Water and Electricity Authority (DEWA) commissioned the largest ground- mounted solar PV plant in the Middle East in 2013. At 13MW, this facility may seem small in comparison to some of the solar PV plants being built in Europe and North America. Yet it was merely a stepping stone onto bigger ambitions.

In 2015, DEWA broke records when it managed to secure the world’s lowest levelised cost of solar energy for a large scale solar PV plant, with the 100MW second phase of its ambitious solar park. Faced with a tariff of $0.0584 per kilowatt hour (kWH), DEWA decided to double the capacity of the project to 200MW, making it one of the world’s largest solar power plants, providing the cheapest cost for electrical energy generation from solar energy ever achieved without government support schemes.

Building on an already impressive track record, DEWA has announced that the next solar phase, to be tendered later this year, will be for an astonishing 800MW, making it one of the largest solar power projects to ever be tendered in a single phase. In neighbouring Abu Dhabi, Abu Dhabi Water and Electricity Authority (ADWEA) has announced a 320MW solar PV project to be tendered soon on a Power Purchase Agreement (PPA) basis, ushering in the era of large-scale solar power plants in an emirate that is already home to Masdar’s 10MW solar PV plant and the 100MW Shams 1 concentrated solar thermal power plant.

In Jordan, the second round of the kingdom’s renewable energy independent power production programme saw three developers bidding under $0.069/kWH. Egypt has also been very bullish about its energy needs; placing its focus on clean renewable energy, it has announced a 2GW feed-in-tariff (FiT) programme for Solar PV in Binban, while also signing several MOUs for solar PV power plant developments across Egypt with multiple international developers and financiers.

At the same time, other oil and gas rich countries such as Kuwait and Qatar are taking notice of current market pricing of solar energy, and for good reason: solar is, today, comparable to the in-country average cost of electricity generated from their current fossil fuel-heavy mix of resources. The Kingdom of Saudi Arabia is also reportedly deliberating these recent groundbreaking prices, as it works on revamping its plans in solar and renewables that were initially announced in 2010.

A review of recent developments of the solar market in the Middle East shows optimism about oil-rich countries alongside oil-poor countries adopting more solar energy to diversify and strengthen their energy mix, but at the same time it also reveals a very dynamic phase in the timeline for market development. It remains to be seen how different banks will react to this wave of aggressive bidding at low LCOEs and whether projects will be finally able to achieve financial close in markets like Jordan.

One could argue that these sizeable initiatives and projects need strong support from a local industry that is still developing expertise across the solar industry value chain, from technology development and manufacturing, to engineering procurement and construction (EPC), to operations and maintenance. Without a developed local industry, one could argue that these new initiatives are taking on significant risks that could have an impact the realisation of the project at hand.

The region is also likely to see more groundbreaking projects, such as hybrid power plants where solar PV or concentrated solar thermal are co-located and integrated with conventional power plants. It is also likely to see the integration of solar technologies for sustainable water treatment and desalination, such as using solar PV plants to run seawater reverse osmosis filtration systems. These are indeed interesting and exciting times for solar in the Middle East, which will surely shape a bright future that is full of well harvested sunshine.

Dr Raed Bkayrat is research director and board member at MESIA; he is also the vice president of Business Development for the Middle East at First Solar, a leading global provider of solar energy solutions.