Anchorage Investments, a company operating in the development, investment, and operation of industrial projects in the petrochemical sector, has said that it is preparing to embark on the engineering and construction of its Anchor Benitoite project in the industrial zone of the Suez Canal Economic Zone.

In a statement, the company said that the project has an investment cost of more than $2 billion, and that it will issue a tender to select the main engineering, procurement, and construction (EPC) contractor for the project.

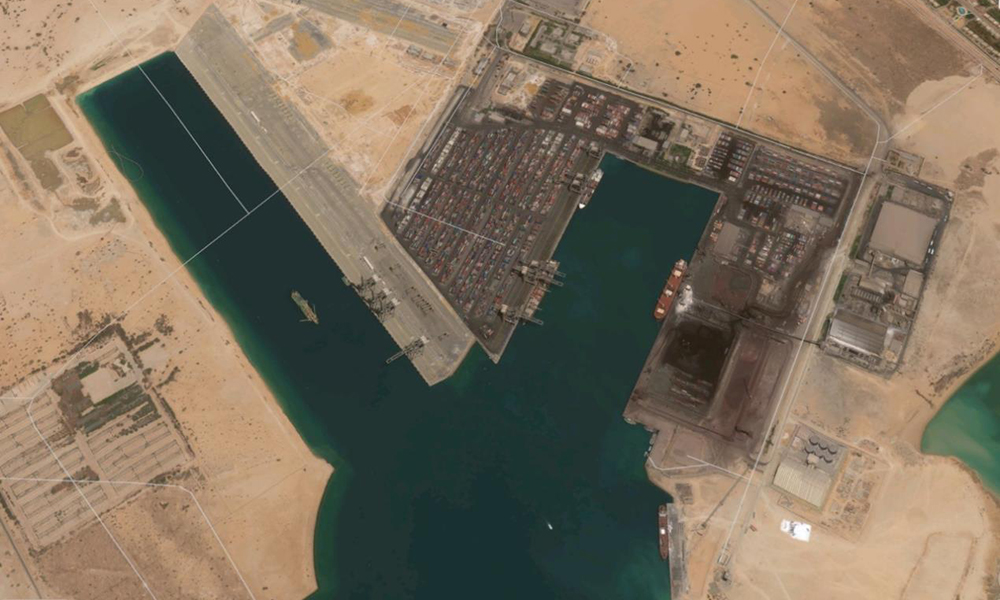

The Anchor Benitoite Project is a major industrial complex in Ain Sokhna, Suez, Egypt, that is to encompass a number of production units to produce a range of derivatives and petrochemical products, intended to accommodate growing regional and global demand.

The project will enhance the economic value of its feedstock of natural gas derivatives, contribute to the growth of Egypt’s GDP, boost the country’s petrochemical exports, and stimulate further foreign direct investment inflows, from foreign and Arab countries, and benefit from the favourable investment climate in Egypt and the promising opportunities in the market, the statement said.

Dr Ahmed Moharram, the Founder and Managing Director of Anchorage Investments, said: “The project is located in the Suez Canal Economic Zone in Ain Sokhna, thanks to the many strategic and economic advantages provided in the industrial zone, the encouraging investment laws and policies, and the favorable investment environment and swift procedural requirements.”

The UAE has been one of Egypt’s top investors, with more investments being funnelled into many Egyptian industries and companies operating in several fields. The volume of direct Emirati investments in Egypt amounted to about $15 billion, which received a further boost at the end of last year when the two countries launched a joint strategic investment platform worth $20 billion.

Moharram highlighted that Egypt has become one of the top destinations in Africa and the Arab world for attracting foreign direct investments in light of the economic, financial, monetary, and structural reform program that it has adopted along the past years, embracing an investment-friendly business environment.

Moharram added: “More than 20 international companies with high credit ratings will participate in the Anchor Benitoite project including pioneering technology licensors, project management firms, feedstock suppliers, products’ off-takers, the operation and maintenance company, and reliable foreign financial institutions and commercial banks.”

Several agreements in the petrochemical sector have been recently announced in the Suez Canal Economic Zone involving major local, foreign, and Arab companies with a total investment volume of more than $10 billion, the statement added.

Anchorage Investments will issue the Pre-Qualification Requirements (PQR) prospectus in mid-March, as the first stage of the EPC tendering process. A shortlist of the world’s top EPC contractors specializing in propane dehydrogenation (PHD) and propylene production will be selected.

The EPC contractor reaching the final selection will be responsible for executing and completing the activities and procedures required for the Front-End Engineering Design (FEED) phase based on an Open Book Cost Estimate (OBCE) subject to conversion to a Lump Sum Turnkey (LSTK) contract encompassing all site preparation, engineering, procurement, and construction works.

The Anchor Benitoite project is expected to be completed within three years following the completion of the engineering and design phase.