The fight for JLG’s future

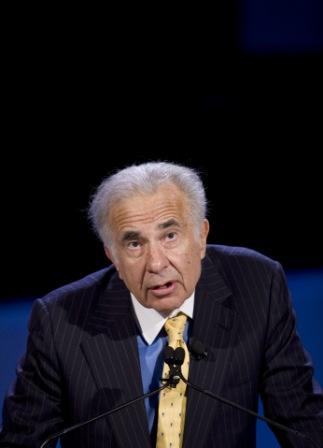

A shareholder meeting in the US in January centred around the future of JLG. The company has been caught up in a battle between the board of Oshkosh and the billionaire investor and no stranger to controversy Carl Icahn.

A shareholder meeting in the US in January centred around the future of JLG. The company has been caught up in a battle between the board of Oshkosh and the billionaire investor and no stranger to controversy Carl Icahn.

It started off as a power struggle at one of the industry’s biggest names and now it has become a battle over the future of one of its favourite niche brands.

Entrepreneur and investor Carl Icahn’s attempt to wrestle control of the board of Oshkosh has become a very public feud on Wall Street with senior executives at the company breaking months of silence to ensure he fails to place six candidates on the board.

Icahn, already the principle owner of US truck giant Navistar can see “synergy” between Oshkosh and Navistar but he wants to look at alternatives – ie sell – for JLG as a potential sale could help pay off company debt and develop the company.

It took a lot of provoking but the speciality vehicles and equipment maker finally broke its self-imposed vow of silence to make a public appeal to its shareholders to not support US billionaire Carl Icahn’s attempt to wrestle control of the company’s board at this month’s shareholder meeting.

Oshkosh, which is one of the world’s biggest manufacturers of trucks and a major military contractor, issued a statement in December asking shareholders to not allow his to replace six members of its board with “his own hand-picked slate of six nominees”.

After buying 10% of Oshkosh’s shares last summer, Icahn became the single biggest shareholder of the company. He is now trying to discredit the board of Oshkosh complaining that it “provides no substantive ideas to proactively enhance shareholder value.”

Harsh words were met with retaliative measures from Oshkosh’s CEO and Chairman Charlies Szews and Richard Donnelly

“Mr. Icahn has not demonstrated that he has a plan or a team that can lead your company and deliver value to all Oshkosh shareholders. Mr. Icahn is seeking to control nearly half of the Oshkosh board, yet has provided no substantive ideas or analyses to enhance value for all shareholders,” they said in a statement.

“We have repeatedly asked Mr Icahn and his team for their ideas regarding the Company and how best to create shareholder value. To date, he has not discussed with us any ideas for creating value or what he thinks the Company should be doing differently for the benefit of Oshkosh shareholders,” said another statement. “We do not believe that Icahn is interested in a dialogue that enhances value for all Oshkosh shareholders.

“Instead, we believe he is pursuing his own personal agenda without regard for the interests of the company and all other shareholders. You should be aware that he has selected as his nominees four candidates who are currently employed by Icahn or one of his entities and another who has had a long relationship with Icahn beginning in college.

“The Oshkosh Board of Directors is committed to acting in your best interests and believes that a board that represents the interests of all shareholders, not just the interests of one shareholder, is better positioned to maximse long-term value and generate superior returns for all shareholders.”

Oshkosh makes military trucks, emergency vehicles, access equipment and a variety of construction-related trucks but has endured a tough couple of years as demand fell for its products in the US. However it has performed better overseas and global sales now account for 17% of total revenue.

The company has made up considerable in emerging markets such as the Middle East. They clearly feel JLG still has potential.

“We expect substantial opportunities for adoption and penetration of our products in emerging markets,” the company said. “Oshkosh’s net sales outside the US grew from 10% in fiscal 2010 to 17% in fiscal 2011. Our goal is to increase this to 30% as our international strategy gains traction.”

For now and until 27 January, the future of JLG hangs in the balance.